Furniture Financing for Dummies

Wiki Article

How Furniture Financing can Save You Time, Stress, and Money.

Table of ContentsThe 2-Minute Rule for Furniture Financing8 Easy Facts About Furniture Financing DescribedNot known Facts About Furniture FinancingA Biased View of Furniture Financing

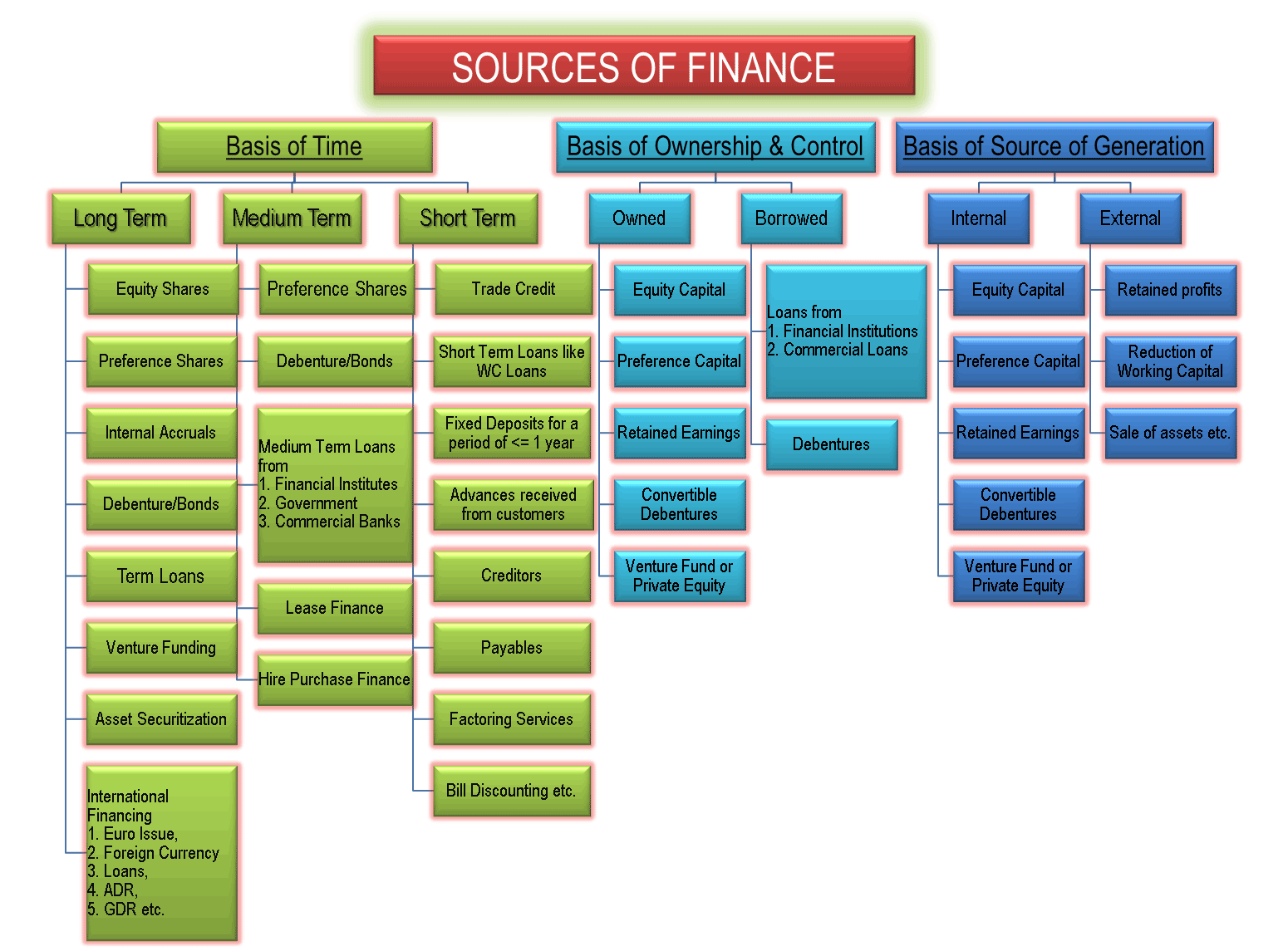

As a result, the company requires to cover this momentary deficit with cash. Short-term funding is made use of in this situation since it is fairly basic to obtain on the short-term, as well as it is received by the firm rapidly. It is relatively simple to pay off financial debt in the short term.Long term financing is a lot more eye-catching for very big investments that take a long time to pay off. There are not really several banks that have enough cash money on hand to make a loan that big, even if they really liked Ford's business plan, but there are millions of financiers who each could be prepared to get some Ford bonds and earn rate of interest.

What are the various kinds of company fundings? A safe lending implies that the customer supplies security if they fail on the lending.

The Basic Principles Of Furniture Financing

An organization credit score card is meant for service usage instead than individual use as well as can help service owners develop credit score, which can translate into better lending rates., of the 1,000 little company owners checked, 50% of women-owned small organizations had never taken outdoors financing in 2020 or prior to that., it can still be challenging for females business owners to access resources.If you are a Square vendor or handling with Square, you could be eligible for a car loan via Square Loans (furniture financing). When you obtain any kind of type of funding, below is some of the documentation a bank or various other lender may intend to see: A plan that explains all aspects of your organization While a lender will likely draw an organization credit report, they may likewise take an appearance at an individual debt report if you have really little borrowing background.

A car loan application will include an expert return to as a method to provide the loan provider context for the experience you have in the sector you are running your organization in. These might include records like an organization certificate or certificate, commercial leases, as well as contracts you may have with 3rd parties, for instance.

All About Furniture Financing

Developing a solid organization credit history is one means to reinforce your situation when using for business credit scores as well as fundings. Each loan provider has different minimum needs and qualifications for what will make Going Here an applicant essentially eligible, yet they normally consist of: In this case, credit report refers to the credit reliability of a service.Concrete assets that might be utilized to secure a loan (only in the instance of a protected funding). The quantity of capital in as well as out of a business. The amount of financial obligation you have. The market of your service is composed of a collection of companies that refine the very same raw materials, items, or solutions.

Business financing sizing Company car loan sizing describes the size or dollar quantity of the lending, and also it can be determined by a number of aspects like debt-to-income ratio, credit rating, and also others. A lender establishes the funding sizing that they may be able to offer a consumer, but this can be a challenging procedure, as customers may be trusting a bigger finance than they might eventually be gotten.

There are two different kinds of financing debt or equity funding. Fundings fall into the debt funding group, which suggests they need to be paid back with interest.

The Basic Principles Of Furniture Financing

You might consider refinancing if it enables you to minimize the rates of interest or shorten the terms of the lending, and also it can be used to a home mortgage or a car finance also. Some company lending terms to recognize Below is a glossary of monetary terms as well as interpretations that you must know in order to make enlightened choices around financings.This refers read here to exceptional invoices a firm has or, much more generally, the money customers owe the business. Accounts payable is cash owed by a service to browse around these guys suppliers or vendors. Amortization refers to spreading out payment over several durations.

In one more sense, it is the amount the consumer is billed for the funding expressed as a yearly price. A lien is a legal right or claim versus properties that are utilized as collateral to satisfy a financial obligation. Liens can take several kinds depending on the kind of possession: a bank lien, judgment lien, technician's lien, genuine estate lien, and extra.

Report this wiki page